Arizona Tax Credit

TAX DOLLARS CAN CHANGE A STUDENT’S LIFE

The deadline to contribute for the tax year 2025 is April 15th, 2026

New Way participates in the Arizona School Tuition Tax Credit through our School Tuition Organization, Financial Assistance for Independent Schools. FAIS was established specifically for New Way to provide tuition assistance for students in financial need. Because many individuals contribute to this fund, even a little gift makes a BIG difference.

In recent school years, over one-fourth of our student population applied for financial assistance through FAIS. The average gift awarded was just over $6,000 (approximately 25% of annual tuition). This year, FAIS was able to award nearly $500,000 in tuition assistance because of our generous corporate and individual tax credit donors.

Your contribution to FAIS as part of the Arizona Private School Tax Credit Program provides a dollar-for-dollar credit on your Arizona state income tax filing.

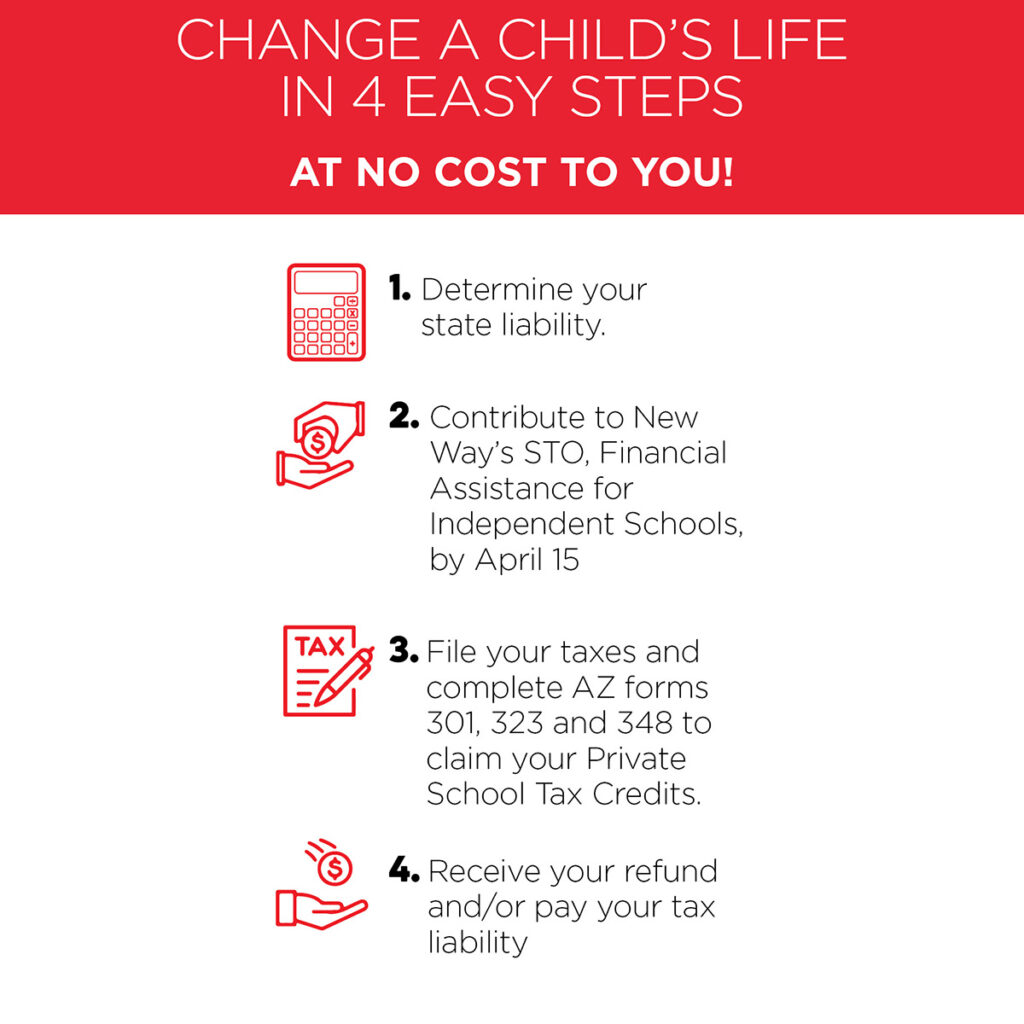

There are four easy steps to help students benefit from a New Way education through your tax credit donation:

2025 TAX CREDIT LIMITS

Individuals: $1,535 | Married Couples: $3,062

DISCLAIMER:

A School Tuition Organization (STO) cannot award, restrict or reserve scholarships solely on the basis of a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. FAIS does not discriminate against any person due to color, race, religion, national origin, disability or gender.

The information contained on this page is not intended to offer taxpayers legal or tax advice. Always consult a tax professional regarding your tax situation. For more information contact the Arizona Department of Revenue at 602-255-3381.